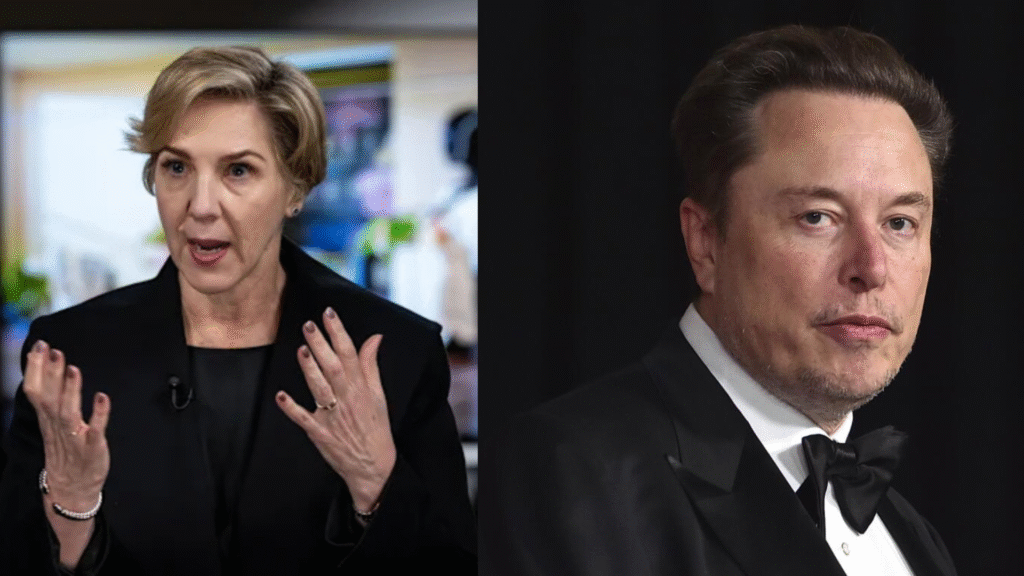

Tesla Chair Robyn Denholm Fights to Keep Elon Musk With $1 Trillion Pay Package

In a high-stakes plea to investors, Tesla Board Chair Robyn Denholm has declared the company is at a “critical inflection point,” warning that Tesla risks losing CEO Elon Musk if shareholders do not approve a unprecedented $1 trillion compensation package designed to secure his leadership for the next decade . The warning sets the stage for a pivotal shareholder vote on November 6, 2025, that will determine the future direction of the electric vehicle giant .

A Direct Appeal from the Top

The campaign to secure Musk’s future at Tesla escalated in October 2025 when Robyn Denholm made a direct appeal to shareholders. In a letter and subsequent interviews, she framed the upcoming vote as a simple but consequential choice: Do you want to retain Elon as Tesla’s CEO to pursue ambitious goals in autonomous technology and artificial intelligence?

Denholm argued that without a compensation plan that motivates Musk, the company runs the risk that he “gives up his executive position,” a move that could cause Tesla to lose “significant value” as a transformative force . “While there may be nothing wrong with being just another car company,” Denholm wrote, “our Board believes that Tesla can be more, that our shareholders deserve more, and that Elon is the right leader to help us achieve our full potential” .

For Robyn Denholm, this challenge is part of her central role on Tesla’s board. Appointed as Chair in 2018 after Musk settled charges with the Securities and Exchange Commission, her background spans the automotive and technology sectors, with experience at Toyota, Sun Microsystems, and as CFO of Australian telecom Telstra . Colleagues have described her as “incredibly focussed on delivery by holding people to account,” a trait being put to the test in the campaign for Musk’s pay package .

More Than Money: The Fight for Control

The proposed compensation package, unveiled in September 2025, is not a traditional pay plan. It offers Musk no salary or cash bonus. Instead, it consists of 12 tranches of restricted stock, which he would only receive if Tesla hits a series of extraordinary milestones . These goals include:

- Increasing Tesla’s market capitalization to $8.5 trillion by 2035

- Shipping 1 million Optimus humanoid robots

- Deploying 1 million robotaxis in commercial operation

If all targets are met, the payout could be worth up to $1 trillion over the next decade, increasing Musk’s stake in Tesla from 13% to nearly 29% . This aspect of the plan—voting influence—is what Musk and Robyn Denholm emphasize is the true objective.

“He’s been very consistent in that view, in terms of having enough influence over the vote at Tesla in the future so that bad things can’t happen with the AI,” Denholm told CNBC. “So it’s less about compensation and more about the voting influence” .

Musk himself has been strikingly transparent about this motivation. On Tesla’s quarterly earnings call, he stated, “I just don’t feel comfortable building a robot army here and then being ousted because of some asinine recommendations from ISS and Glass Lewis who have no freaking clue. I mean, those guys are corporate terrorists” .

He further explained that with voting control in the “mid-20s” percent range, he would have enough influence to steer Tesla’s AI and robotics development while still being accountable to shareholders .

Significant Opposition and Legal Precedent

The proposal faces substantial headwinds. Major proxy advisory firms Institutional Shareholder Services (ISS) and Glass Lewis have both recommended investors vote against the package . ISS cited “unmitigated concerns” with the plan’s “magnitude and design,” noting that while retention is a key reason for the award, “there are no explicit requirements” to ensure Musk focuses his time on Tesla amid his other ventures .

This new pay package comes after years of legal battles. A Delaware judge struck down Musk’s previous 2018 compensation plan, calling the $55.8 billion award an “unfathomable sum” that was excessive and approved through a flawed process . Rather than create a fundamentally new plan, Tesla’s board, led by Robyn Denholm, put a similarly structured but even larger package forward for a vote .

The legal context remains active. In October 2025, the Delaware Supreme Court heard arguments in the appeal of the case that voided the 2018 package. The court’s decision, expected in the coming months, could have lasting implications for corporate governance and executive compensation far beyond Tesla .

Beyond the Boardroom: Challenges at Tesla

The debate over Musk’s compensation occurs against a backdrop of other challenges at Tesla. The company has faced reports of a significant talent exodus, with numerous high-profile executives and veteran engineers departing over the past year .

When asked about these departures, Robyn Denholm pushed back, stating that media focuses only on people leaving and not on new hires. She described Tesla as “still a magnet for talent” with “outstanding” bench strength . However, when pressed, she could not name a single significant recent hire, according to critics who track the company’s personnel movements .

The Stakes for November 6

As the November 6 shareholder meeting approaches, the arguments from both sides have crystallized. For Musk and Robyn Denholm, the package is an investment in future growth and a necessary incentive to keep Musk focused on Tesla’s most ambitious projects.

For opponents, it represents an excessive grant of power and compensation that lacks sufficient safeguards. Some analysts have noted that under the plan’s structure, Musk could still receive tens of billions of dollars even if Tesla delivers below-average returns to shareholders .

The outcome of the vote will send a powerful message about shareholder confidence in Musk’s long-term vision and the board’s strategy, championed by Robyn Denholm. A rejection could trigger the very scenario Denholm warns of—Musk stepping back from leadership. An approval would arm Musk with unprecedented voting power and set Tesla on a course to pursue goals that many in the industry view as nearly impossible.

With the future of the world’s most valuable automaker hanging in the balance, Robyn Denholm has made the board’s position unmistakably clear: bet on Elon Musk, or risk losing him entirely.