Intel (intc) Delays Ohio Chip Plant to 2030 Amid Strategy Shift and Workforce Cuts

NEW ALBANY, Ohio—Intel Corporation (intc) is postponing its $28 billion Ohio semiconductor manufacturing complex until 2030—five years behind schedule—while abandoning a flagship chip technology initiative and cutting up to 20% of its factory workforce, according to internal documents and federal filings reviewed by this publication.

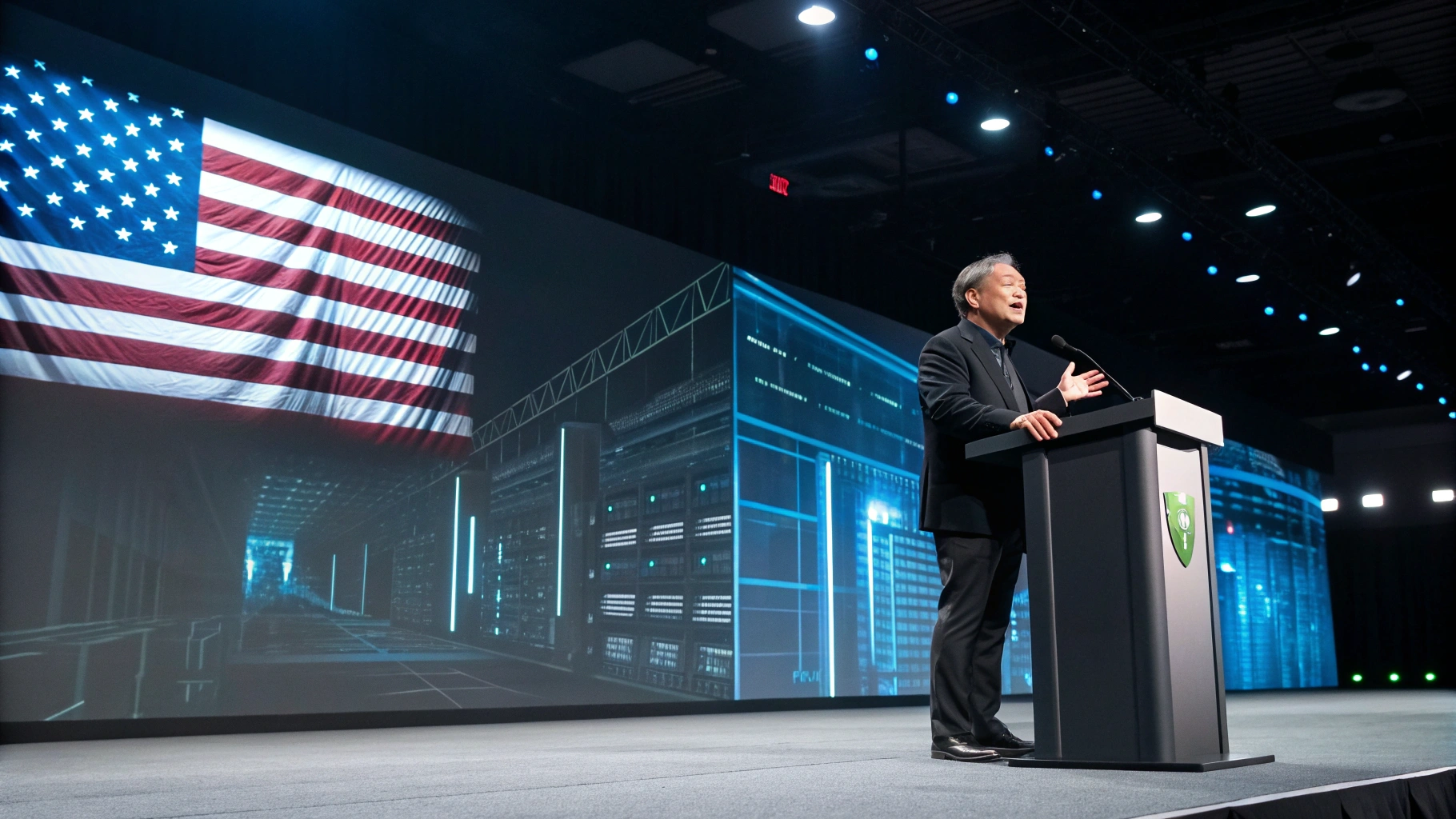

The sweeping changes mark new CEO Lip-Bu Tan’s aggressive overhaul of the struggling chipmaker’s strategy amid $18.8 billion in losses and uncertain federal funding.

Manufacturing Pivot: From 18A to 14A

Tan, who took leadership in March 2025, is halting external marketing of Intel’s (intc) 18A chipmaking process—a “generational leap” promoted by predecessor Pat Gelsinger. Despite billions invested, the technology attracted only limited orders from Microsoft and Amazon, with Intel itself as its primary user.

Industry analysts confirm the retreat could trigger “financial write-offs in the hundreds of millions—potentially billions—of dollars”.

Resources will shift to the 14A node, targeting mass production by 2027. Tan aims to outpace Taiwan’s TSMC, whose N2/N3 technologies dominate advanced chip production.

Securing clients like Apple or Nvidia—currently loyal to TSMC—is critical for Intel’s (intc) foundry revival.

Ohio Delays: “Prudent Approach” or Broken Promise?

At Intel’s (intc) 1,000-acre New Albany site, cranes tower over unfinished factories where activity has slowed to a crawl.

The first fab will now open in 2030–2031, with the second delayed to 2032—a major setback for a project originally slated for 2025.

- Local Fallout: The slowdown jeopardizes 3,000 promised Intel (intc) jobs and 7,000 construction roles. “We poured 200,000 cubic yards of concrete last year,” said a union foreman. “Now crews are skeleton-staffed”.

- Funding Uncertainty: CHIPS Act subsidies—including $7.9B earmarked for Intel (intc)—are stalled under Trump administration reviews. Only $2.2B has been disbursed to date

Naga Chandrasekaran, Intel’s manufacturing chief, cited “aligning with market demand” and “financial responsibility” as drivers.

Workforce Reductions: “Painful but Necessary”

Internal memos reveal plans to cut 15–20% of manufacturing roles (≈10,000 jobs) starting mid-July. Oregon and Arizona sites face the deepest cuts, compounding 2024’s 15,000 layoffs.

- Employee Toll: “They call it ‘portfolio alignment,’” texted a 12-year Oregon technician. “Feels like broken promises.”

- Leadership Philosophy: Tan defends the move, stating: “The best leaders get the most done with the fewest people”. The cuts aim to save $500M in operational costs and $2B in capital spending.

Financial Freefall and Geopolitical Strains

The restructuring follows Intel’s (intc) catastrophic 2024—a $18.8B net loss, its first unprofitable year since 1986. Tariffs and policy shifts exacerbate the crisis:

- Steel/Aluminum Tariffs: Proposed 25% tariffs could raise costs for Intel’s (intc) Ohio plant, which requires massive metal imports.

- Ownership Rumors: TSMC explored acquiring 20% of Intel’s (intc) foundry unit, though White House officials oppose foreign control of U.S. fabs.

Human Toll Beyond Headlines

In Licking County, small businesses reel from the delays. Superior Electrical Supply invested $300,000 in inventory for Intel’s site.

“We bet everything on this project,” said owner Luis Rivera. “Now we’re stuck with debt and zero income through 2030”.

Ohio’s FastTrack job-training program—launched for Intel (intc) roles—paused enrollments. “Workers mastered clean-room protocols for nothing,” said union rep Diane O’Connor.

Tan’s Gamble: Can intc Regain Leadership?

All eyes turn to Intel’s (intc) July 24 earnings call, where Tan must convince investors his 14A bet can:

- Close TSMC’s technology gap by 2027

- Secure anchor clients amid tariff disruptions

- Stabilize a company losing relevance in AI chips

As Constellation Research’s Holger Mueller observed: “Abandoning what was pitched as Intel’s savior takes courage—but delay is no longer an option”